Welcome to Anwire

www.anwire .org

“Welcome to our digital frontier where technology intertwines with society, science, health and wellness. At ANWIRE, we navigate the ever-evolving landscape of innovation, harnessing the power of technology to enhance lives and build a healthier, more connected world. Explore with us as we delve into the intersections of technology and human well-being, forging paths towards a brighter, more sustainable future.”

Technology

Step into the realm of technology, where the pulse of innovation beats incessantly. In our dedicated section, you’ll find a curated collection of articles and news pieces exploring the ever-expanding universe of technological advancement. From breakthroughs in AI and biotech to the latest trends in cybersecurity and renewable energy, we invite you to stay informed and inspired by the transformative power of technology. Welcome to a world where progress knows no bounds.

Articles About Technology

Whether you’re intrigued by the mysteries of the universe, the latest tech innovations, societal dynamics, or ways to enhance your health and wellbeing, there’s something here for everyone

Transforming The Future With Cisco Technology

As a seasoned tech enthusiast, I delve into the realm of Cisco technology. From networking solutions to cybersecurity…

What Is Dependent Variable In Science: A Starter Guide

When conducting experiments in science, understanding the concept of a dependent variable is crucial. It’s the variable that…

Unlocking Lucrative Careers: Jobs With Exercise Science Degree

Are you passionate about health and fitness? Curious about the career opportunities with an exercise science degree?

Trends by our tech expert Qylorinthyx Myxalindor

Online Slot App That Syncs Well With Your Account

Have you ever thought, “Why does my slot app not remember my settings or balance?” Or maybe you’ve switched devices and found it difficult to

Passenger Rights After a Car Wreck: What You’re Entitled To

When a car accident occurs, passengers often find themselves in a tough situation. They didn’t cause the crash, weren’t driving the vehicle, and couldn’t prevent

Create Your Dream Sweepstakes Casino: A Game-Changer Guide

Sweepstakes casinos are quickly but surely taking the online gaming stage by storm. The combination of the casino-style games with the chance to win real

CMMC and FedRAMP: Which Cybersecurity Standard is Right for Your Business?

When it comes to cybersecurity, businesses must ensure that their systems and data are protected from cyber threats. For companies that do business with the

The Latest Trends in AI Technology for Creative Projects

Artificial intelligence (AI) has evolved into a cornerstone of innovation across industries, revolutionizing how we work, create, and communicate. Its applications in content and entertainment

Avatar: The Way of Water Full Movie Analysis, Plot, and Visual Spectacle

As a die-hard fan of the Avatar franchise, I’ve been eagerly anticipating the release of Avatar: The Way of Water Full Movie since its announcement. This

Research insights from our science blogger Qyloxandryl Vexondris

Financial Software Development Company: Your Fintech Startup’s Secret Weapon

Fintech startups are shaking up the finance world. In just a few years, innovators have disrupted everything from banking and payments to personal investing. Global

What Is The Difference Between Hoteling And Hot Desking?

The modern office has undergone a significant transformation. Traditional assigned desks and rigid schedules are being replaced by flexible workspace solutions designed to support

Comoros as a Forex Licensing Destination: Pros and Cons

Forex brokers seeking an affordable and strategic location for their offshore business are increasingly looking to Comoros, an island nation in the Indian Ocean. As

The Role of Multi-Currency Support in Online Slots

Online slots have become a popular platform for gaming enthusiasts, offering a wide variety of games, exciting bonuses, and an immersive experience. One of the

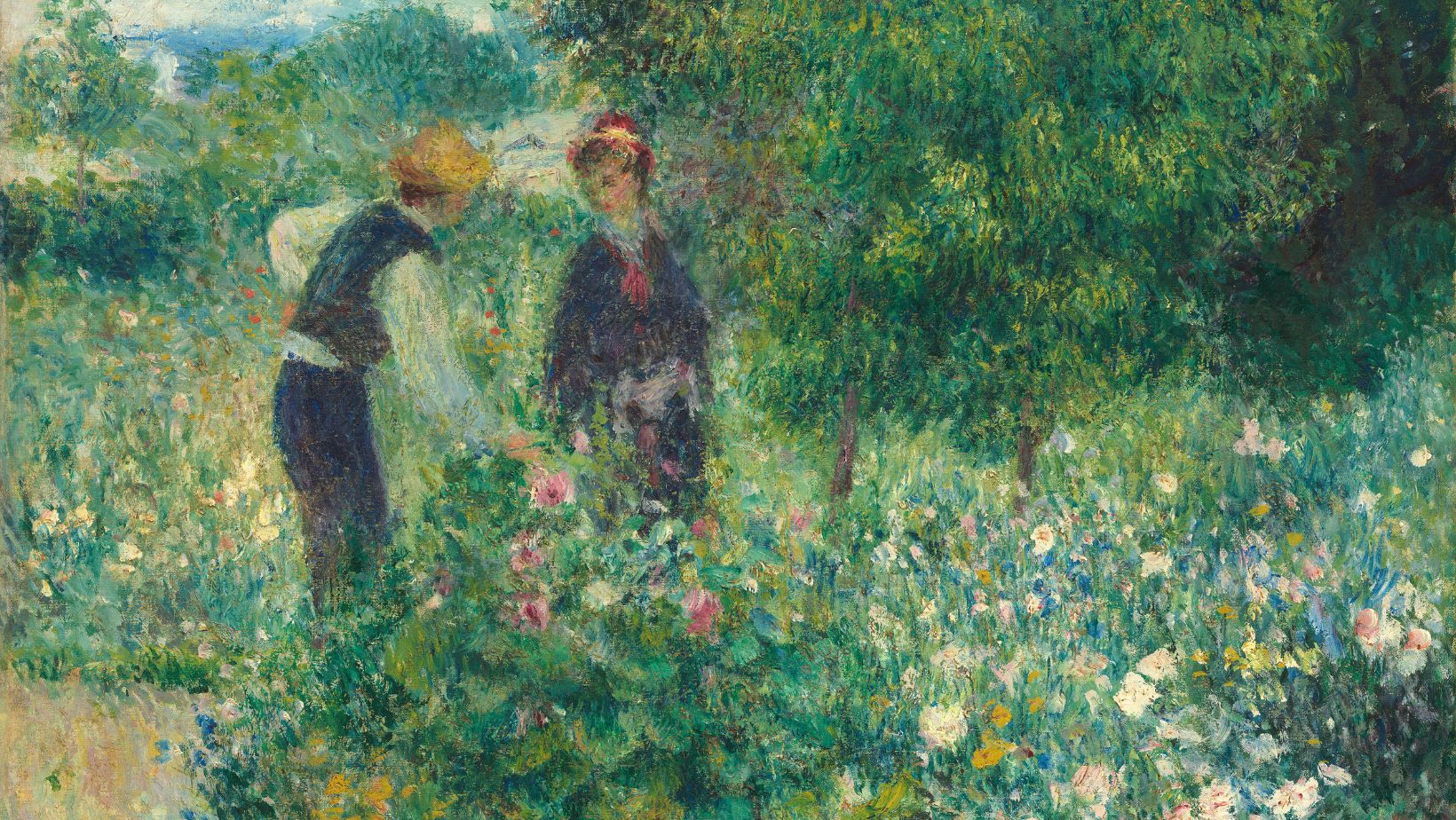

Science

Explore the wonders of science, where curiosity knows no bounds. Immerse yourself in a world of discovery through our curated collection of articles and news pieces. From the marvels of biodiversity to the mysteries of quantum mechanics, journey through the vast expanse of scientific inquiry. Join us in unraveling the complexities of the universe and celebrating the beauty of exploration.

Meet The Experts

Discover the experts behind AnWire.org, where technology, science, and society meet. Our seasoned professionals offer expert analysis and insights on innovative advancements and societal challenges.

Sarah B. Johnson

Alicia Michelle

Michael Rich

Responsible strategies

Responsible Strategies Set the Benchmark for Gaming Operators

Sports betting and casino operator Flutter Entertainment launched its inaugural sustainability strategy, referred to as the ‘Positive Impact Plan,’ in 2022. The strategy is designed