The tech sector has spent the past decade driving market gains, shaping innovation, and transforming industries. But with valuations soaring and economic uncertainties lingering, investors continue to ask whether tech is still overvalued or if it remains a long term engine of growth.

The Valuation Debate: Is Tech Really Too Expensive?

Concerns about tech overvaluation often surface when stock prices rise faster than earnings. High price to earnings ratios can signal vulnerability, especially in a high rate environment, while supporters argue that tech’s scalability and recurring revenue justify premium pricing.

Market dynamics can also amplify moves. For example, when sudden volatility or sharp price spikes occur, traders sometimes explain it by referencing short squeeze meaning, which describes a rapid jump in price when short sellers are forced to buy back shares. While not unique to tech, this shows how momentum can push valuations beyond fundamentals.

Still, many leading tech companies continue to post strong earnings, healthy margins, and steady growth. What may seem expensive at first glance often looks more reasonable when long term revenue expansion and market potential are factored in.

Tech as the Engine of Global Innovation

Regardless of valuation debates, few sectors match tech when it comes to shaping global innovation. Artificial intelligence, cloud computing, cybersecurity, semiconductors, and digital payments form the backbone of modern economic infrastructure. These categories are not only growing but becoming essential for both businesses and governments.

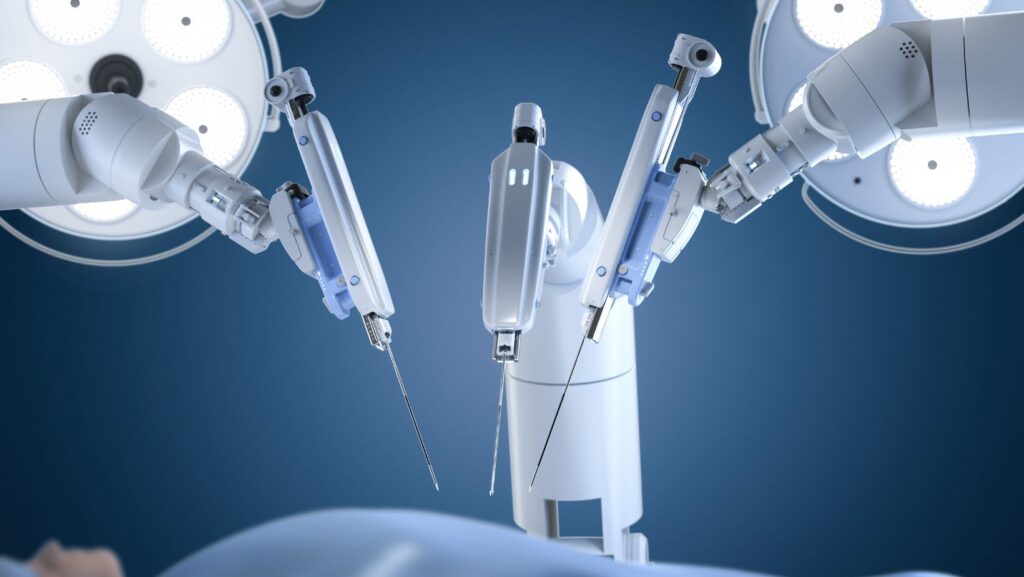

AI stands out as the biggest driver of future tech value. Companies across every industry are integrating machine learning into operations, product development, and decision making. From personalized medicine to autonomous vehicles to automated supply chains, AI is creating new efficiencies and entirely new markets. Investors who treat AI as a long term transformation rather than a short lived trend often view the sector differently. They see structural growth rather than speculative exuberance.

Cloud computing remains another powerful growth engine. Even after years of expansion, global cloud adoption continues to accelerate as organizations modernize legacy systems and transition to flexible, scalable infrastructure. The recurring nature of cloud revenue gives many tech giants a stable foundation that supports long term valuation strength.

Cybersecurity also reinforces tech’s role as a critical sector. With digital threats escalating, demand for advanced security solutions is rising among enterprises, small businesses, and governments. This creates a durable revenue stream and positions cybersecurity companies as defensive plays within the broader tech ecosystem.

Macroeconomic Forces That Influence Tech Valuations

Interest rates, inflation, and global market sentiment heavily influence how investors value tech companies. When interest rates rise, future earnings are discounted more aggressively, which can pressure high growth stocks. Conversely, rate cuts often give tech a tailwind as cheaper capital supports expansion and innovation.

Economic uncertainty can also shift investor behavior. During periods of volatility, some investors seek defensive sectors, while others still gravitate toward tech because of its resilience and long term potential. Even in downturns, demand for software, cloud tools, and digital services rarely collapses entirely. This stability often reinforces the belief that tech is not merely a speculative sector but a core component of modern economic life.

Regulation is another factor shaping valuation. Governments worldwide are increasing oversight of artificial intelligence, data privacy, competition, and digital platforms. While additional regulation may create short term friction, it can also stabilize the industry by creating clearer frameworks that support sustainable innovation.

Long Term Growth: What Makes Tech Different

Tech has unique characteristics that set it apart from traditional industries:

- Scalability. Digital products can be replicated at near zero marginal cost, allowing companies to grow revenue quickly without proportional increases in expenses.

- Recurring revenue models. Subscription based platforms generate predictable, long term cash flows.

- Network effects. Platforms become more valuable as more users join, giving established companies a significant competitive moat.

- Rapid innovation cycles. Tech firms can continually reinvent themselves through updates, new features, and new lines of business.

- Global reach. Many tech products can scale internationally without major operational changes.

These advantages explain why many investors treat tech valuations differently from other sectors. Even if prices appear elevated, the long term compounding effect of innovation driven growth can justify premiums that would seem unreasonable elsewhere.

So Is Tech Overvalued or Just Powerful?

The answer is not absolute. Some areas of tech may indeed be overpriced, especially companies with weak earnings and heavy reliance on hype. Others are supported by strong fundamentals, rising demand, and dominant market positions that justify long term value.

For long term investors, the real question is less about whether tech is overvalued today and more about whether its innovation cycle will continue to drive economic transformation. If AI, cloud computing, cybersecurity, and digital infrastructure keep expanding at the expected pace, the sector will likely remain a major engine of global growth for years to come.

In the end, tech may face short term volatility, regulatory shifts, and evolving competition, but its role as a driver of modern progress is clear. For investors who can look beyond temporary price swings, the sector remains one of the most compelling long term opportunities in the market.