In the past decade, the way we handle money has transformed dramatically. Paper bills and plastic cards are giving way to digital wallets, QR codes, and biometric verification. What began as a fintech experiment is now the default mode of transaction for millions of people worldwide, especially younger generations who expect seamless, contactless experiences in every part of life.

Interestingly, some of the earliest and most enthusiastic adopters of this technology are in industries you might not expect. For example, users comparing Google Pay casinos are participating in a much broader global trend, one that’s redefining how consumers think about convenience, privacy, and financial trust. The gambling sector has become a revealing testbed for how digital wallets evolve, scale, and eventually influence the rest of the economy.

From Niche Technology to Everyday Utility

The rise of digital wallets was gradual but inevitable. Google Pay, Apple Pay, and similar platforms promised a frictionless way to pay, fast, secure, and integrated with smartphones already in everyone’s pockets. By 2025, global mobile-wallet transactions are projected to exceed $15 trillion, according to data from Statista, with adoption spreading rapidly in Asia, Europe, and North America alike.

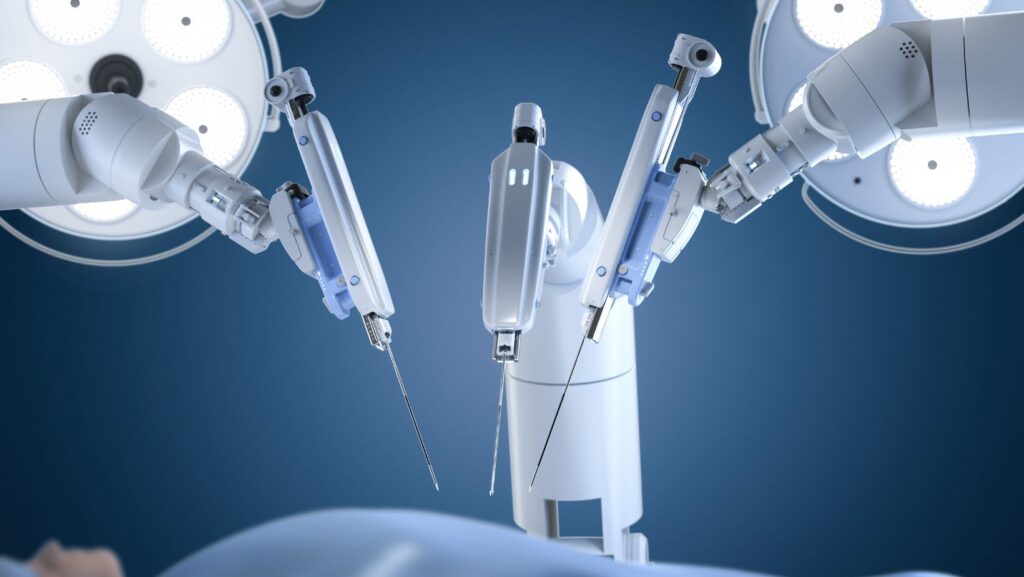

Early adoption was driven by retail and transit systems. But as trust grew, consumers began to explore new use cases: food delivery, subscription services, gig-economy apps, and eventually entertainment, including online gaming and casino platforms. For fintech companies, the gaming industry presented the ideal sandbox for innovation: frequent microtransactions, global users, and a constant demand for faster, safer payments.

Why Casinos Are the Perfect Payment Laboratory

Casinos, both online and physical, operate at the intersection of entertainment, finance, and psychology. Every second matters: delays between intention and action can break engagement. That’s why gaming platforms were quick to integrate instant-payment systems long before banks or retailers streamlined theirs.

Digital wallets fit this environment perfectly. They allow real-time deposits and withdrawals without exposing sensitive bank details, reduce transaction fees, and eliminate friction for international users. For operators, the benefit is dual: improved user retention and fewer failed transactions. For players, it’s speed and convenience without the hassle of traditional banking.

But there’s a deeper insight here: casinos serve as early adopters of payment infrastructure that later becomes mainstream. Much like how streaming platforms transformed entertainment or e-commerce reshaped logistics, the gaming industry is quietly shaping tomorrow’s financial behavior.

Trust, Transparency, and the New Currency of Experience

The digital wallet revolution isn’t just about payments, it’s about trust architecture. Traditional banking relies on physical cards, signatures, and institutional reputation. Digital wallets, in contrast, depend on encryption, device identity, and user verification.

This subtle shift has changed how people perceive financial security. Instead of trusting the teller at a counter, users now trust the device in their hand, and the brand behind the software. That’s why companies like Google have invested heavily in privacy layers, transaction encryption, and user-side authentication.

In sectors like online gaming, that trust is tested constantly. Players expect transparency on fees, withdrawals, and bonuses, and they’re quick to abandon platforms that mishandle funds. In this way, digital wallets have become the currency of user experience. The better the payment flow, the higher the perceived legitimacy of the entire brand.

A Mirror for Broader Financial Behavior

Casinos also highlight how mobile payments influence spending psychology. Studies show that consumers spend 15–20% more when paying digitally versus with cash, simply because the transaction feels less tangible. This behavior extends beyond gaming, affecting retail, dining, and travel sectors as well.

In Anne Arundel County or London alike, digital-first consumers expect fast, almost invisible payment experiences. But the challenge is maintaining self-awareness. When transactions are instantaneous, it’s easy to lose track of budgeting or time spent. That’s why fintech developers are embedding spending alerts, timers, and analytics tools into digital wallets, blending convenience with responsibility.

Casinos’ integration of these features (spending limits, activity tracking, “cool-off” periods) offers a useful model for other industries managing consumer engagement ethically.

The Global Push for Cashless Regulation

As mobile payments expand, regulators worldwide are adapting to ensure transparency and fairness. In the European Union, PSD2 (Payment Services Directive) laid groundwork for open banking and wallet interoperability. In the U.S., state-level agencies are crafting new guidelines for digital-payment licensing and data protection.

Interestingly, gaming regulation has often preceded financial regulation in this field. Casinos, being heavily monitored industries, were among the first required to implement anti-fraud, KYC (Know Your Customer), and anti-money-laundering (AML) measures within digital-wallet systems.

The result: many of today’s mobile payment compliance frameworks borrow directly from lessons learned in the gambling sector. What began as a regulatory necessity for casinos has now evolved into a template for fintech at large, ensuring that convenience never comes at the cost of transparency.

Why It Matters Beyond Gaming

If you rarely gamble, you might wonder what this has to do with you. The answer: everything. The innovations tested in next-gen casinos are quickly crossing over into mainstream finance.

- Frictionless microtransactions developed for gaming are now used in ride-sharing, tipping, and creator-economy apps.

- Identity verification tools built to stop underage gambling now protect online banking and telemedicine.

- Real-time payment rails first adopted for global gaming markets are being implemented by major payment processors like Stripe and Visa.

Each of these examples illustrates how one high-velocity industry can accelerate technology that later defines entire economies.

The Future: From Wallets to Ecosystems

The next phase of digital payments isn’t just about wallets, it’s about ecosystems. Tech companies are bundling payments, identity, and loyalty into unified systems that connect daily life: transportation, shopping, entertainment, even healthcare.

In that sense, the innovation cycle we see in online casinos, fast testing, user feedback, global scalability, is a microcosm of the digital economy itself. Every time a player taps “Pay with Google,” they’re reinforcing the infrastructure that powers e-commerce, streaming, and subscription services around the world.

Tomorrow’s consumer won’t ask whether they can use digital wallets; they’ll ask why they’d use anything else.

The rise of google pay casinos might look like a niche tech story, but in truth, it’s a mirror reflecting the future of global finance. Digital wallets are redefining not only how we transact, but how we trust, behave, and connect.

What starts in gaming rarely stays there. Just as social media grew from college networks to reshape global communication, the tools powering instant casino payments will soon drive every aspect of our digital economy.

And as that future unfolds, one thing is clear: the house doesn’t always win, but frictionless technology does.